The 6 Principles of Money

The 6 Principles of Money

by Stock Shock

May 9, 2024

6 Min

Tye Bousada, a hedge fund manager from Edgepoint Wealth, has been a founding partner there for over 16 years and manages $30 billion dollars in assets under management (AUM). So he knows a few things about money management.

He wrote this brilliant letter for his kids and we wanted to summarize it as the 6 Principles of Money that students across the world need to understand.

Aim not to be poor

Spend less than you earn

Understand the power of compounding

Don’t lose money

Importance of a financial advisor

Financial freedom helps you get wealthier

Here is the full letter…

Number 1: Aim Not to Be Poor

“Some people start adulthood with the goal/hope of being rich. The richest people I know today set out with the goal of not being poor. For example, think about which of the following two statements is more motivating: “I want to lead a healthy lifestyle” or “I don’t want to be an unhealthy, overweight, lethargic, couch potato because I don’t want to die young of some crappy disease.”

Now that you’re getting older, there’s a very good chance at some point in your life you needed something that you didn’t have the money for, and that feeling sucked. I guarantee you that feeling only gets worse the older you get.”

Number 2: Spend Less Than You Earn

“So easy to say, so hard to do. There are few things as limiting to freedom as debt. Some of the unhappiest people I’ve met are unhappy because they’ve never figured this one out. If you regularly spend more than you make, you’re destined to be poor for the rest of your life.”

Number 3: Understand the Power of Compounding

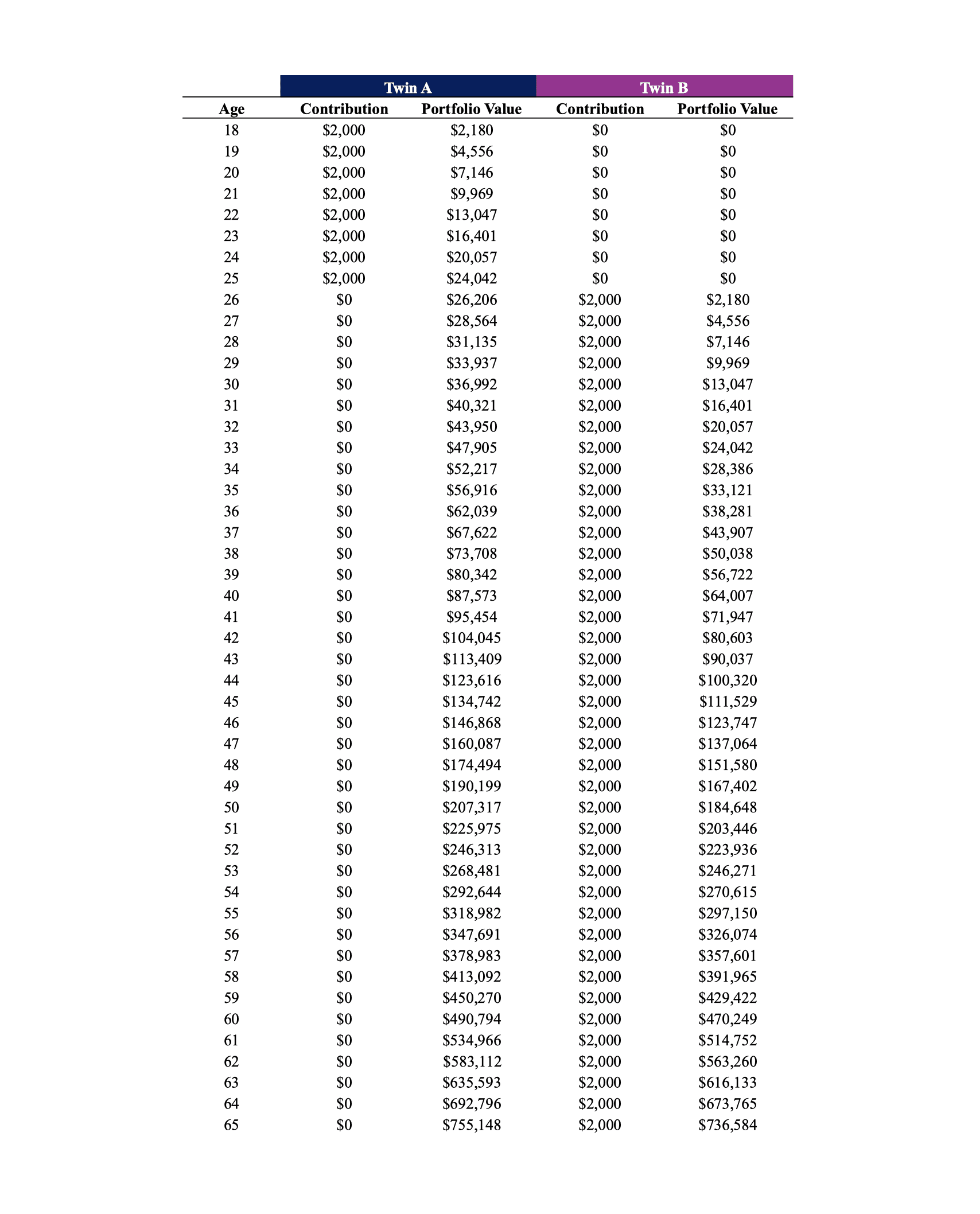

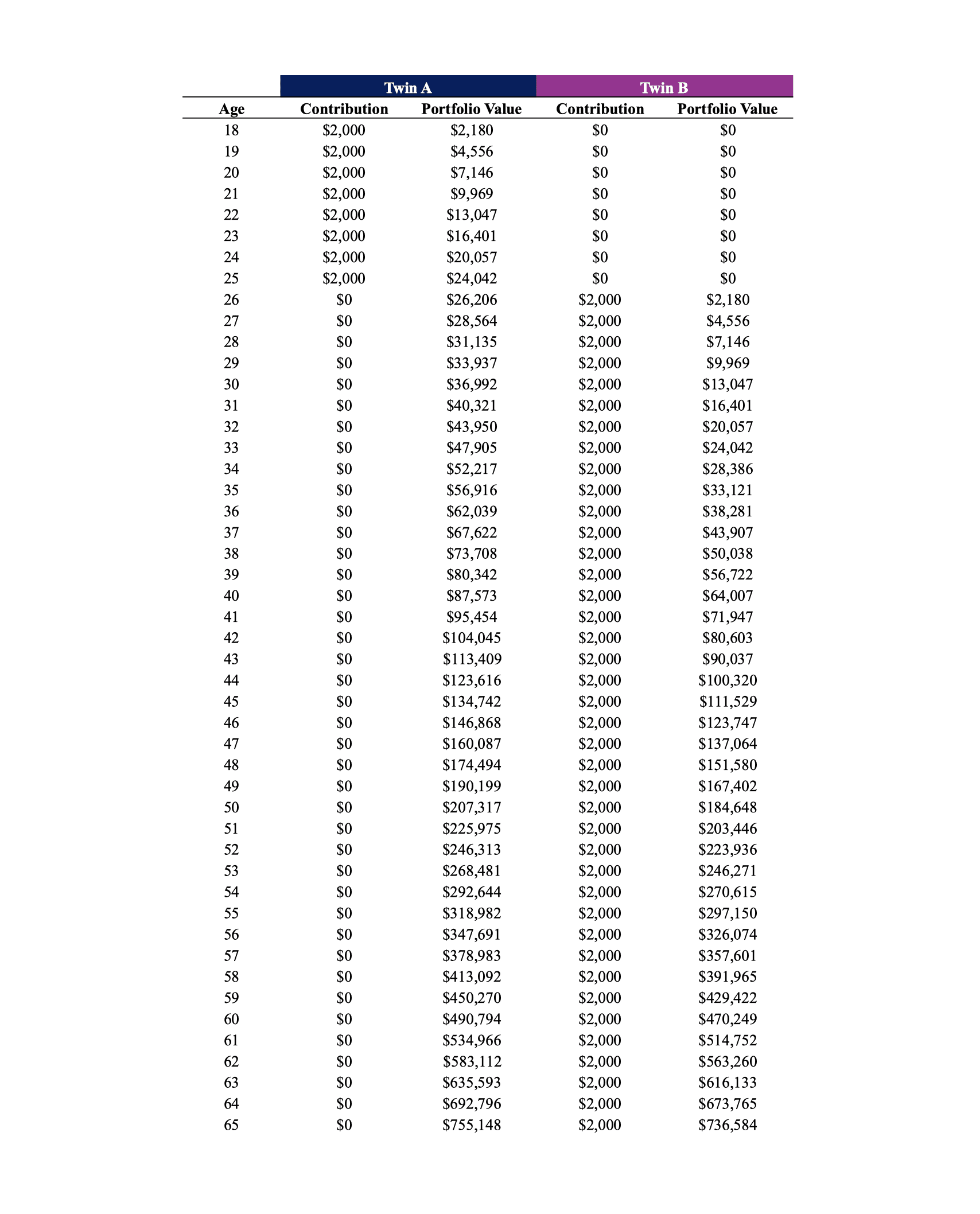

“Let’s assume there are two twins, Twin A and Twin B, turning 18 today. Twin A saves $2,000 a year for eight years and then never saves a dime again. Twin B doesn’t save anything for the first eight years but then saves $2,000 a year until he reaches 65.

Just saving money isn’t enough because stuff generally gets more expensive every year due to inflation. If you just hold your money in cash and don’t invest it, you might not be able to afford much in the future because of inflation. Here’s a Forbes article discussing how inflation erodes savings.

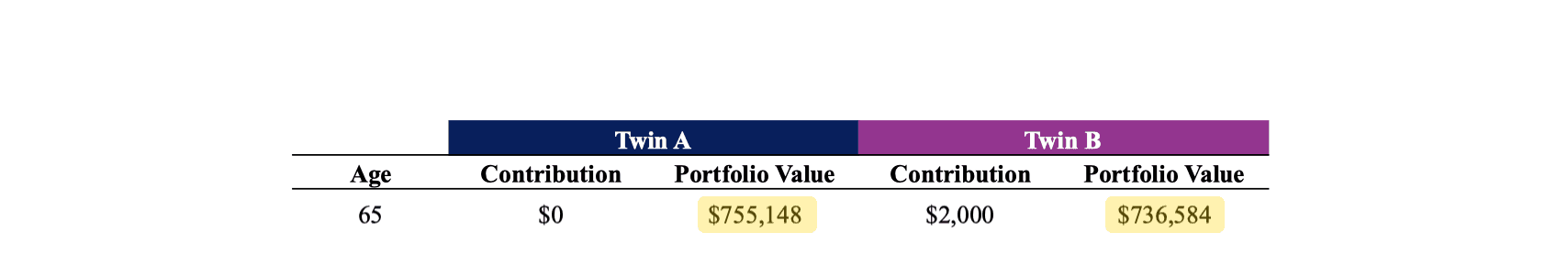

Now back to the example, we’re going to assume that you invest your money in the stock market. You both buy a good collection of businesses that increases in value by 9% every year. You’re probably asking yourself, why 9%? I picked that number because it’s the long-term return of the market over a super-long time (going all the way back to 1802), its not guaranteed but helpful for our example. Here’s a table that shows what happens to your investment over time:

Most Important line:

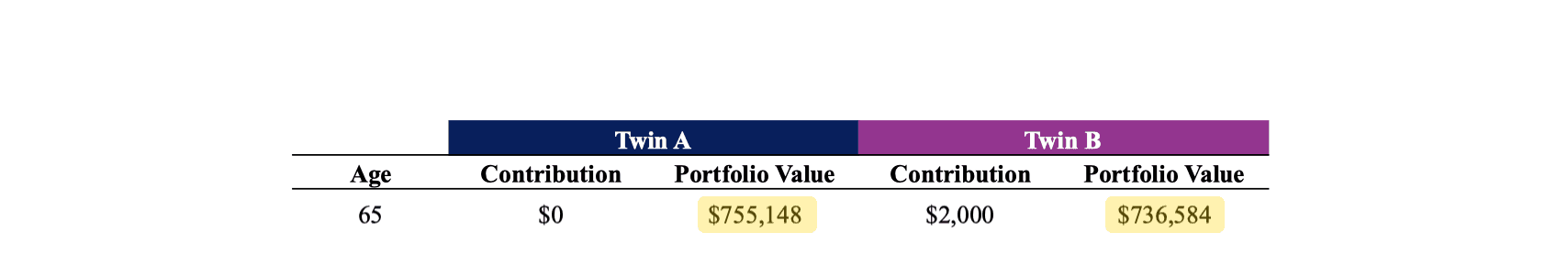

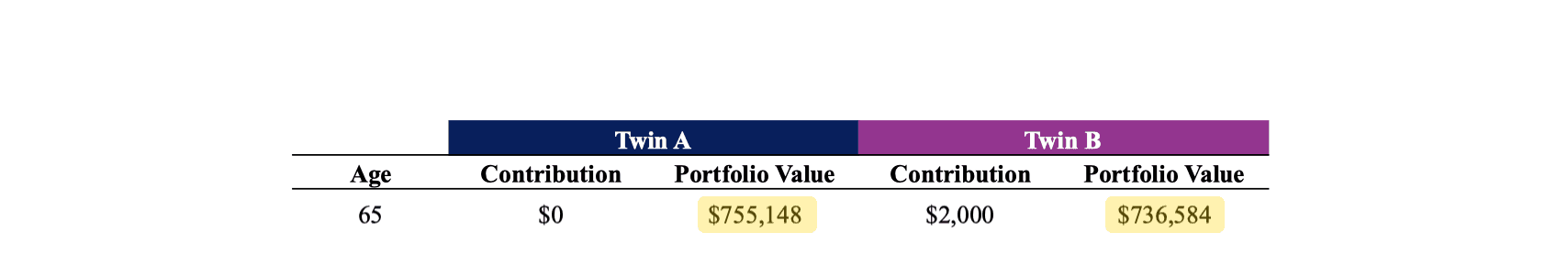

After saving $2,000 a year for only eight years, Twin A, you get to retire with $755,148 in the bank. After saving for 40 years, Twin B you have $736,584. There are two important points in this example.

The first is after only eight years of saving $2,000 a year, Twin A has the opportunity to turn her savings into $755,148.

Even though Twin B saves for 40 years and Twin A for only eight, Twin A still retires with more.

What makes this math deceptively simple? The deception is in the fact that it can be brutally hard to save $2,000 a year because you want or need stuff now. You want the newest phone, the luxury brand jacket, or your weekend away with friends. You have student loans, your car insurance, rent.

Almost all will accept that it’s tough to save and therefore won’t save. A few will decide they don’t want to be poor and forgo some consumption today. Saving $2,000 a year, or $5.50 a day for eight years, can help you not be poor. Again, this can’t guarantee you’ll be financially stable nor is saving $5.50/day some kind of magic formula.”

Number 4: Don't Lose Money

“Your brain usually makes you want to invest your money in the exact wrong thing at the exact wrong time. After a lot of people have made money investing in something, it gives others confidence to also invest in that area; however, usually the money has already been made and you’re investing in something that’s really expensive.

Alternatively, when everyone is very fearful of investing because something bad is going on in the world, usually that makes you nervous as well. Historically, however, it’s when most people are fearful that a lot of money can be made investing.

One of the big keys to not losing money is fighting your brain. You must try to live in a narrow emotional band. It’s hard to save, and it’s even harder to constantly fight the feelings of fear and greed that go hand in hand with investing. If you can overcome the emotions, you increase your chance of not being poor. How do you increase your chances of winning the war against your brain? Read the next point.”

Number 5: The Importance of Having a Good Financial Advisor

“You’re probably asking, “What is a financial advisor?” An advisor is part psychologist, part money manager. Very simply, the best advisors help prevent you from separating yourself from your money. A good advisor will lay out a long-term financial plan for you and help you stick to it so that you can actually achieve something like what the table above shows.

How do you find a good advisor? A good place to start might be to ask the sharpest person you know if they would recommend their advisor. If they say yes, contact the advisor to see if they’re taking on new clients and, just as importantly, to see if the advisor makes sense for you. In your interview, ask them for examples of successes they’ve had with other clients. If they start going on about a stock that they recommended doubling in price, then thank them for their time and look for someone else. If they instead talk about helping clients through the highs and lows that go hand in hand with investing in an effort to achieve their client’s goals, then you might have yourself a winner.

Once you hire an advisor, pay a lot of attention to what they recommend. Think about whether their recommendations are based on facts and solid reasoning. Are they always recommending something that makes you feel comfortable because everyone else is doing the same thing? If so, fire them and look for someone that seems to understand that investing isn’t always supposed to make you feel all warm and fuzzy. Are they always trying to get you to buy something that has already doubled in price, or are they regularly calling you after the price of one of your investments falls and telling you to sell? If so, then fire them and look for a new advisor who lives in that narrow emotional band.”

Number 6: Financial freedom leads to more wealth

“I have observed that wealthy people have an advantage in that they don’t always feel the need to be invested in something. If investment opportunities look too expensive, they can wait. When they finally see something that looks like a deal, they can pounce. The wealthy person doesn’t need the stock or bond or real estate market. These markets are simply tools for them.

However, many people that aren’t wealthy find themselves needing the markets. They need their investments to appreciate quickly so that they can catch up from not saving enough over time. They approach investing with unreasonable expectations and, as such, they look at the stock or bond or real estate market as sources of worry instead of opportunity.

Investing can be boiled down to two simple things: You’re either making a mistake or capitalizing on a mistake someone else has made. It’s tough to be the one that takes advantage of mistakes if your judgment is clouded by hope. Sound judgment can be a positive by-product of a life lived trying not to be poor instead of one lived trying to be rich.”

My final thought

“Most people equate wealth with freedom/happiness. I want you to have the freedom to pursue your interests in the future, which will make you most happy. Of course, there’s no easy way to become wealthy.

If there was, the world would be rich and it isn’t for a reason. I have observed over time that people who have accumulated enough wealth to freely pursue their interests have a solid understanding of the six points above.”

Tye Bousada, a hedge fund manager from Edgepoint Wealth, has been a founding partner there for over 16 years and manages $30 billion dollars in assets under management (AUM). So he knows a few things about money management.

He wrote this brilliant letter for his kids and we wanted to summarize it as the 6 Principles of Money that students across the world need to understand.

Aim not to be poor

Spend less than you earn

Understand the power of compounding

Don’t lose money

Importance of a financial advisor

Financial freedom helps you get wealthier

Here is the full letter…

Number 1: Aim Not to Be Poor

“Some people start adulthood with the goal/hope of being rich. The richest people I know today set out with the goal of not being poor. For example, think about which of the following two statements is more motivating: “I want to lead a healthy lifestyle” or “I don’t want to be an unhealthy, overweight, lethargic, couch potato because I don’t want to die young of some crappy disease.”

Now that you’re getting older, there’s a very good chance at some point in your life you needed something that you didn’t have the money for, and that feeling sucked. I guarantee you that feeling only gets worse the older you get.”

Number 2: Spend Less Than You Earn

“So easy to say, so hard to do. There are few things as limiting to freedom as debt. Some of the unhappiest people I’ve met are unhappy because they’ve never figured this one out. If you regularly spend more than you make, you’re destined to be poor for the rest of your life.”

Number 3: Understand the Power of Compounding

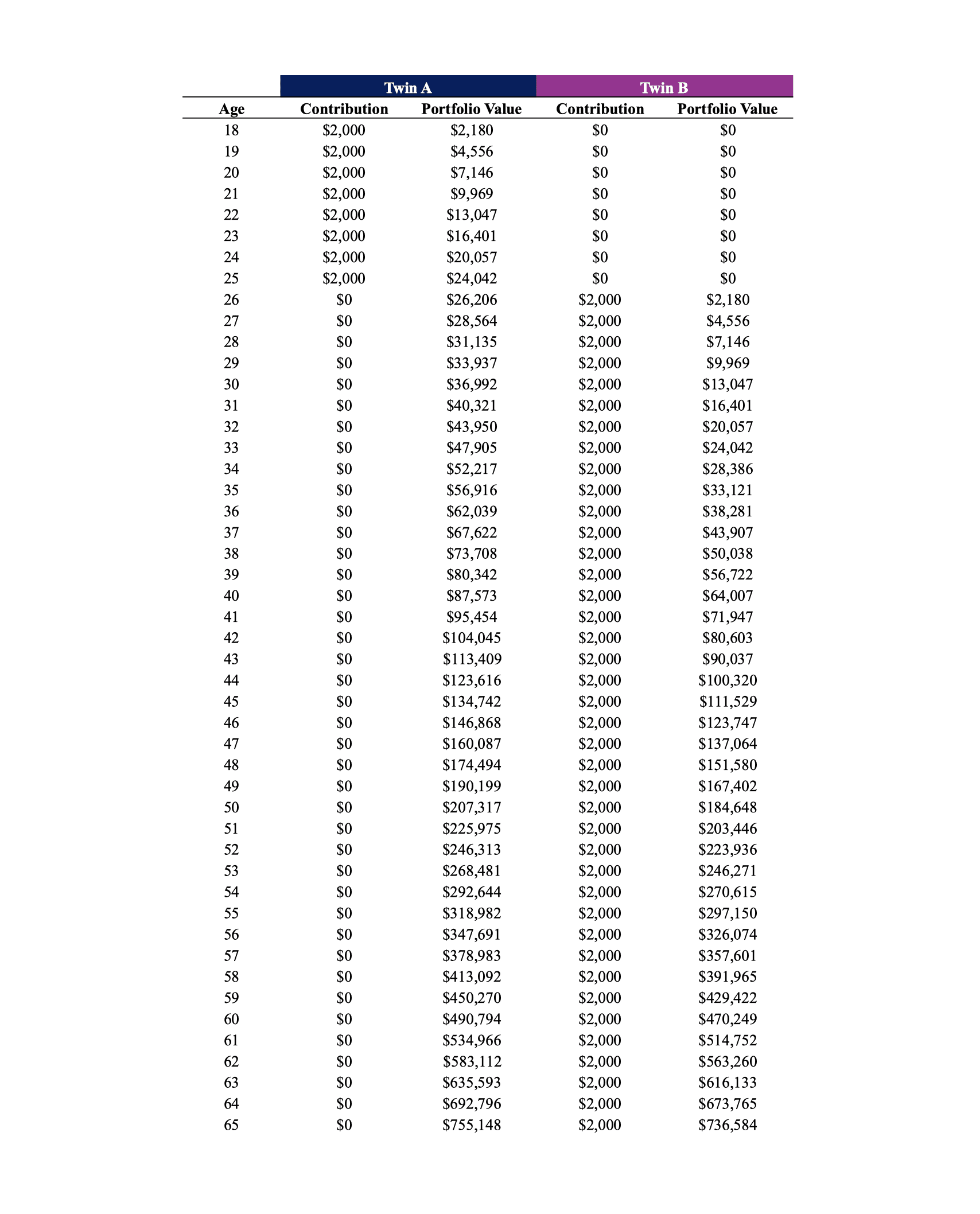

“Let’s assume there are two twins, Twin A and Twin B, turning 18 today. Twin A saves $2,000 a year for eight years and then never saves a dime again. Twin B doesn’t save anything for the first eight years but then saves $2,000 a year until he reaches 65.

Just saving money isn’t enough because stuff generally gets more expensive every year due to inflation. If you just hold your money in cash and don’t invest it, you might not be able to afford much in the future because of inflation. Here’s a Forbes article discussing how inflation erodes savings.

Now back to the example, we’re going to assume that you invest your money in the stock market. You both buy a good collection of businesses that increases in value by 9% every year. You’re probably asking yourself, why 9%? I picked that number because it’s the long-term return of the market over a super-long time (going all the way back to 1802), its not guaranteed but helpful for our example. Here’s a table that shows what happens to your investment over time:

Most Important line:

After saving $2,000 a year for only eight years, Twin A, you get to retire with $755,148 in the bank. After saving for 40 years, Twin B you have $736,584. There are two important points in this example.

The first is after only eight years of saving $2,000 a year, Twin A has the opportunity to turn her savings into $755,148.

Even though Twin B saves for 40 years and Twin A for only eight, Twin A still retires with more.

What makes this math deceptively simple? The deception is in the fact that it can be brutally hard to save $2,000 a year because you want or need stuff now. You want the newest phone, the luxury brand jacket, or your weekend away with friends. You have student loans, your car insurance, rent.

Almost all will accept that it’s tough to save and therefore won’t save. A few will decide they don’t want to be poor and forgo some consumption today. Saving $2,000 a year, or $5.50 a day for eight years, can help you not be poor. Again, this can’t guarantee you’ll be financially stable nor is saving $5.50/day some kind of magic formula.”

Number 4: Don't Lose Money

“Your brain usually makes you want to invest your money in the exact wrong thing at the exact wrong time. After a lot of people have made money investing in something, it gives others confidence to also invest in that area; however, usually the money has already been made and you’re investing in something that’s really expensive.

Alternatively, when everyone is very fearful of investing because something bad is going on in the world, usually that makes you nervous as well. Historically, however, it’s when most people are fearful that a lot of money can be made investing.

One of the big keys to not losing money is fighting your brain. You must try to live in a narrow emotional band. It’s hard to save, and it’s even harder to constantly fight the feelings of fear and greed that go hand in hand with investing. If you can overcome the emotions, you increase your chance of not being poor. How do you increase your chances of winning the war against your brain? Read the next point.”

Number 5: The Importance of Having a Good Financial Advisor

“You’re probably asking, “What is a financial advisor?” An advisor is part psychologist, part money manager. Very simply, the best advisors help prevent you from separating yourself from your money. A good advisor will lay out a long-term financial plan for you and help you stick to it so that you can actually achieve something like what the table above shows.

How do you find a good advisor? A good place to start might be to ask the sharpest person you know if they would recommend their advisor. If they say yes, contact the advisor to see if they’re taking on new clients and, just as importantly, to see if the advisor makes sense for you. In your interview, ask them for examples of successes they’ve had with other clients. If they start going on about a stock that they recommended doubling in price, then thank them for their time and look for someone else. If they instead talk about helping clients through the highs and lows that go hand in hand with investing in an effort to achieve their client’s goals, then you might have yourself a winner.

Once you hire an advisor, pay a lot of attention to what they recommend. Think about whether their recommendations are based on facts and solid reasoning. Are they always recommending something that makes you feel comfortable because everyone else is doing the same thing? If so, fire them and look for someone that seems to understand that investing isn’t always supposed to make you feel all warm and fuzzy. Are they always trying to get you to buy something that has already doubled in price, or are they regularly calling you after the price of one of your investments falls and telling you to sell? If so, then fire them and look for a new advisor who lives in that narrow emotional band.”

Number 6: Financial freedom leads to more wealth

“I have observed that wealthy people have an advantage in that they don’t always feel the need to be invested in something. If investment opportunities look too expensive, they can wait. When they finally see something that looks like a deal, they can pounce. The wealthy person doesn’t need the stock or bond or real estate market. These markets are simply tools for them.

However, many people that aren’t wealthy find themselves needing the markets. They need their investments to appreciate quickly so that they can catch up from not saving enough over time. They approach investing with unreasonable expectations and, as such, they look at the stock or bond or real estate market as sources of worry instead of opportunity.

Investing can be boiled down to two simple things: You’re either making a mistake or capitalizing on a mistake someone else has made. It’s tough to be the one that takes advantage of mistakes if your judgment is clouded by hope. Sound judgment can be a positive by-product of a life lived trying not to be poor instead of one lived trying to be rich.”

My final thought

“Most people equate wealth with freedom/happiness. I want you to have the freedom to pursue your interests in the future, which will make you most happy. Of course, there’s no easy way to become wealthy.

If there was, the world would be rich and it isn’t for a reason. I have observed over time that people who have accumulated enough wealth to freely pursue their interests have a solid understanding of the six points above.”

Tye Bousada, a hedge fund manager from Edgepoint Wealth, has been a founding partner there for over 16 years and manages $30 billion dollars in assets under management (AUM). So he knows a few things about money management.

He wrote this brilliant letter for his kids and we wanted to summarize it as the 6 Principles of Money that students across the world need to understand.

Aim not to be poor

Spend less than you earn

Understand the power of compounding

Don’t lose money

Importance of a financial advisor

Financial freedom helps you get wealthier

Here is the full letter…

Number 1: Aim Not to Be Poor

“Some people start adulthood with the goal/hope of being rich. The richest people I know today set out with the goal of not being poor. For example, think about which of the following two statements is more motivating: “I want to lead a healthy lifestyle” or “I don’t want to be an unhealthy, overweight, lethargic, couch potato because I don’t want to die young of some crappy disease.”

Now that you’re getting older, there’s a very good chance at some point in your life you needed something that you didn’t have the money for, and that feeling sucked. I guarantee you that feeling only gets worse the older you get.”

Number 2: Spend Less Than You Earn

“So easy to say, so hard to do. There are few things as limiting to freedom as debt. Some of the unhappiest people I’ve met are unhappy because they’ve never figured this one out. If you regularly spend more than you make, you’re destined to be poor for the rest of your life.”

Number 3: Understand the Power of Compounding

“Let’s assume there are two twins, Twin A and Twin B, turning 18 today. Twin A saves $2,000 a year for eight years and then never saves a dime again. Twin B doesn’t save anything for the first eight years but then saves $2,000 a year until he reaches 65.

Just saving money isn’t enough because stuff generally gets more expensive every year due to inflation. If you just hold your money in cash and don’t invest it, you might not be able to afford much in the future because of inflation. Here’s a Forbes article discussing how inflation erodes savings.

Now back to the example, we’re going to assume that you invest your money in the stock market. You both buy a good collection of businesses that increases in value by 9% every year. You’re probably asking yourself, why 9%? I picked that number because it’s the long-term return of the market over a super-long time (going all the way back to 1802), its not guaranteed but helpful for our example. Here’s a table that shows what happens to your investment over time:

Most Important line:

After saving $2,000 a year for only eight years, Twin A, you get to retire with $755,148 in the bank. After saving for 40 years, Twin B you have $736,584. There are two important points in this example.

The first is after only eight years of saving $2,000 a year, Twin A has the opportunity to turn her savings into $755,148.

Even though Twin B saves for 40 years and Twin A for only eight, Twin A still retires with more.

What makes this math deceptively simple? The deception is in the fact that it can be brutally hard to save $2,000 a year because you want or need stuff now. You want the newest phone, the luxury brand jacket, or your weekend away with friends. You have student loans, your car insurance, rent.

Almost all will accept that it’s tough to save and therefore won’t save. A few will decide they don’t want to be poor and forgo some consumption today. Saving $2,000 a year, or $5.50 a day for eight years, can help you not be poor. Again, this can’t guarantee you’ll be financially stable nor is saving $5.50/day some kind of magic formula.”

Number 4: Don't Lose Money

“Your brain usually makes you want to invest your money in the exact wrong thing at the exact wrong time. After a lot of people have made money investing in something, it gives others confidence to also invest in that area; however, usually the money has already been made and you’re investing in something that’s really expensive.

Alternatively, when everyone is very fearful of investing because something bad is going on in the world, usually that makes you nervous as well. Historically, however, it’s when most people are fearful that a lot of money can be made investing.

One of the big keys to not losing money is fighting your brain. You must try to live in a narrow emotional band. It’s hard to save, and it’s even harder to constantly fight the feelings of fear and greed that go hand in hand with investing. If you can overcome the emotions, you increase your chance of not being poor. How do you increase your chances of winning the war against your brain? Read the next point.”

Number 5: The Importance of Having a Good Financial Advisor

“You’re probably asking, “What is a financial advisor?” An advisor is part psychologist, part money manager. Very simply, the best advisors help prevent you from separating yourself from your money. A good advisor will lay out a long-term financial plan for you and help you stick to it so that you can actually achieve something like what the table above shows.

How do you find a good advisor? A good place to start might be to ask the sharpest person you know if they would recommend their advisor. If they say yes, contact the advisor to see if they’re taking on new clients and, just as importantly, to see if the advisor makes sense for you. In your interview, ask them for examples of successes they’ve had with other clients. If they start going on about a stock that they recommended doubling in price, then thank them for their time and look for someone else. If they instead talk about helping clients through the highs and lows that go hand in hand with investing in an effort to achieve their client’s goals, then you might have yourself a winner.

Once you hire an advisor, pay a lot of attention to what they recommend. Think about whether their recommendations are based on facts and solid reasoning. Are they always recommending something that makes you feel comfortable because everyone else is doing the same thing? If so, fire them and look for someone that seems to understand that investing isn’t always supposed to make you feel all warm and fuzzy. Are they always trying to get you to buy something that has already doubled in price, or are they regularly calling you after the price of one of your investments falls and telling you to sell? If so, then fire them and look for a new advisor who lives in that narrow emotional band.”

Number 6: Financial freedom leads to more wealth

“I have observed that wealthy people have an advantage in that they don’t always feel the need to be invested in something. If investment opportunities look too expensive, they can wait. When they finally see something that looks like a deal, they can pounce. The wealthy person doesn’t need the stock or bond or real estate market. These markets are simply tools for them.

However, many people that aren’t wealthy find themselves needing the markets. They need their investments to appreciate quickly so that they can catch up from not saving enough over time. They approach investing with unreasonable expectations and, as such, they look at the stock or bond or real estate market as sources of worry instead of opportunity.

Investing can be boiled down to two simple things: You’re either making a mistake or capitalizing on a mistake someone else has made. It’s tough to be the one that takes advantage of mistakes if your judgment is clouded by hope. Sound judgment can be a positive by-product of a life lived trying not to be poor instead of one lived trying to be rich.”

My final thought

“Most people equate wealth with freedom/happiness. I want you to have the freedom to pursue your interests in the future, which will make you most happy. Of course, there’s no easy way to become wealthy.

If there was, the world would be rich and it isn’t for a reason. I have observed over time that people who have accumulated enough wealth to freely pursue their interests have a solid understanding of the six points above.”